You're too hot and fun to be stressed about money.

Plus most methods you've probably tried are too complicated, too restrictive or just fluff that doesn't work.

Let's back up.

DOES THIS SOUND LIKE YOU RIGHT NOW?

You’re stuck in a tug-of-war between living life and saving for the future. You feel like you should be paying off debt or investing—but you also don't want to miss your friend's wedding or skip out on your gym membership you love.

Even though you've made more money over the years, it never seems to be enough to make you feel fully safe, protected, or totally comfortable.

You’ve tried to use a budget or plan finances before, but it’s felt restrictive or unexpected things come up and you always end up saying ‘screw it’ and spending even more.

You have this lingering shame that you still don't understand finances, investing or how your debt works. You've fully convinced yourself it's too complicated and to put it off until later.

You have big money goals like buying a house, paying for a wedding, staring a family, or investing....but also have trips coming up and get overwhelmed trying to choose what to prioritize.

You love treating yourself—whether it’s shopping or dinner out—but then that little voice of guilt creeps in when you’re looking at your credit card bill or monthly statement.

What You Walk Away With:

- Investment accounts and automations set up and ready to grow passively

- Optimized retirement plan and outline of exactly how to hit that goal

- Plan to increase credit score to be able to leverage lower interest rates for home-buying or other major purchases

- Debt payoff plan in motion and strategies already implemented to decrease interest paid to lenders and time spent paying off debt

- Health Savings Account optimized and set up to support long term goals

- Emergency fund set up and either started or fully funded to create more safety and stability

- A decrease in stress and overwhelm when it comes to finances and future planning

- A wealth building strategy to know how in a worst-case scenario you'll still be become a millionaire at retirement

Take 1 min to apply

Imagine this...

- You have an excellent credit score, at least one property, a multi-six figure investment portfolio, maxed out retirement accounts, fully funded emergency fund and extra money to put toward your goals.

- Your investment account is popping off-- and you feel confident when you log into it because you finally get to see your money earning you money passively (& it feels so damn good).

- You have no high interest debt (bye, credit cards!) or even no debt at all.

- You trust your financial decisions completely. No more second-guessing or guilt when you treat yourself to new clothes, book that dreamy vacation, or enjoy a night out at your favorite spot.

- You have a roadmap to the life of your dreams and you're creating generational wealth.

- Your “worst case scenario” is being a millionaire at retirement.

- You don't stress about money. You’ve built a sense of freedom, security, and appreciation for money as the tool that helps you live the life you’ve always wanted.

- You never overthink, overanalyze, or obsess over your finances. You’ve set up systems that run in the background, leaving you with more time and peace of mind to focus on living.

- Money just feels easy. You finally feel allowed to spend money now, and love knowing that you're also prioritizing your future planning too.

Welcome to your new reality.

Ready to Take the Next Step?

This is not a “buy now” page — it’s a personalized selection process so we can ensure you get real results.

Your Next Step:

- Fill out a 1-minute application

- You have a 15 min call to make sure this is the best program to get you the results you want (no salesy vibes, ever).

- During the call we’ll craft a plan + payment options that truly work for your life.

You always leave that call with clarity & next steps, even if this isn’t the right program for you.

ONLY TAKES 1 MINUTE!So, what's the setup?

The Coaches

MEET YOUR COACHES

Chloe Elise

HEAD COACH

Chloe Elise is the CEO and founder of Deeper Than Money®, a global financial literacy company dedicated to empowering and educating people on how to build guilt-free wealth. After paying off over $36,000 of debt in 18 months and becoming debt-free at 22 years old, Chloe watched her life transform as she learned how to build wealth without giving up her lifestyle. Chloe became a millionaire at 27, is now a multi-millionaire who also owns multiple properties.

Chloe was born and raised in Iowa, but now lives in Kansas City, Missouri with her two pups, Rosie and Millie. She is a financial expert, host of a top finance podcast, and author of Deeper Than Money: Ditch Shame, Build Wealth, and Feel Confident AF. Chloe has worked with thousands of clients around the globe to provide education on debt management, investing, and finances through the Deeper Than Money approach- a holistic approach to using money in a way that is emotionally, mentally, and logistically aligned with who we are today and who we want to become.

Chloe believes that financial education is more than learning how to budget, pay off debt, or save for retirement. It’s about the freedom that financial stability can provide, being able to live life to the fullest, feel confident, give generously, and improve the lives of those around us.

CASE STUDY

Let's take Hallie, a 29 year old nurse, making $67,000/year

- She has a pesky $2,000 credit card she can’t seem to pay off since she struggles with overspending, so she just pays the minimum.

- She has $12,000 in federal unsubsidized student loans and isn’t sure if she should pay them off faster.

- She wants to know what to do with the old 401(k) she has from her previous employer ($41,000).

- She is wondering if she should open a Roth IRA or increase contributions through her employer.

- She is getting married soon and also wants to buy a house in the near future.

- She is stressed about money and feels lost because she doesn’t have a plan.

SHE'S DEBATING BETWEEN THESE 2 OPTIONS...

FINANCIAL ADVISOR

ROUTE 👨🏻💼

Advisor recommends she opens a Roth IRA ($7,000) and do a 401(k) rollover ($41,000). It's "free" to meet with him but he will charge a 1% Advisory Fee to setup and monitor the accounts. Conversation with her advisor are strictly investment-focused.

- They do her 401(k) rollover.

- They open a Roth IRA for her and advise her to max it out each year.

- She doesn't get advice about credit card debt.

- She doesn't get advice advice about student loans.

- She gets an email from her advisor once a year to set up a meeting.

- She feels relieved that she doesn’t have to do any of the accounts herself, but she still feels lost about how investing fits in with her overall plan.

THE WEALTH ACCELERATOR

ROUTE 👩🏼💻

She goes through The Wealth Accelerator and after 12 weeks, she:

- Discovered the root cause of overspending and now she has $300/month freed up cash flow that she can put towards other goals.

- Strategically attacked her credit card debt and saved $1,400 on interest that she would have paid to Visa!

- Learned how investing works and how to choose her investment strategy (and what to look for if she wanted to use an advisor).

- Learned how to set up a Roth IRA and do a 401(k) rollover on her own, and set up automations so she can sit back and watch her money grow long-term.

- Since she doesn’t have an advisor, she is saving 1% per year— which over 20 years will save her over $30K in advisory fees.

- Negotiated a raise of $5,000 a year at work.

- Opened a high yield savings account and determined how much she should keep in her emergency fund. She now earns $500/year in interest!

- Created a spend plan that fits her life (& now she feels confident about how to combine finances with her husband one day.)

- Knows how and where to start saving/investing for a future down payment.

- Has tons tools & strategies in her back pocket to help her save thousands in the home buying process.

- Increased her credit score 60 points (which will help her get approved for a lower interest rate on her future mortgage— saving THOUSANDS).

- Determined whether or not she qualified for Public Service Loan Forgiveness for her student loans since she works for a non-profit hospital.

- Knows how to save and invest for future children down the road.

- Has a transformed money mindset and no longer feels stressed about money!

- She invests in the program up front, and gets lifetime access to the modules and future content additions.

- She is part of the Wealth Accelerator Alumni group where she can ask questions she has in the future and get them answered by coaches.

- She feels so empowered, educated, and excited about every area of her finances (investing, debt, savings, goals, credit score, future goals).

There is nothing wrong with working with an advisor. However, it's important to understand it is not your ONLY option. There’s also many reasons why hiring an advisor (especially for high level strategy) can be a phenomenal decision, but it isn’t the best decision for everyone.

Why? A lot of times people are not aware of the fees they are paying or how their advisor is being compensated so they can't make an informed decision of the value are getting value. In this example, we assumed only a 7% growth rate (10% based on historical data -3% for inflation). An advisor's goal is typically to "outperform the market", however oftentimes with fees, it's more difficult to.

In this example, if Hallie would have gone through The Wealth Accelerator, learned how to do the rollover and set up the Roth IRA-- she could have made an empowered decision of if the cost of an advisor was worth it to her.

Advisor groups typically have hundreds of clients and portfolios to manage, so it's understandable that they can't spend time covering student loans strategy, helping clients create a spend plan, dive into money mindset, teach how to raise her credit score, negotiate, and more.

You also used to not be able to invest on your own, or invest on your own without being an expert in day trading. Things have changed, but many people don’t realize that with new automations, you are now able to have the option to set up and automate your own investing account, get strong returns based on historical data, and sit back and watch your portfolio grow without a 1-2% advisor fee.

This is why The Wealth Accelerator exists.

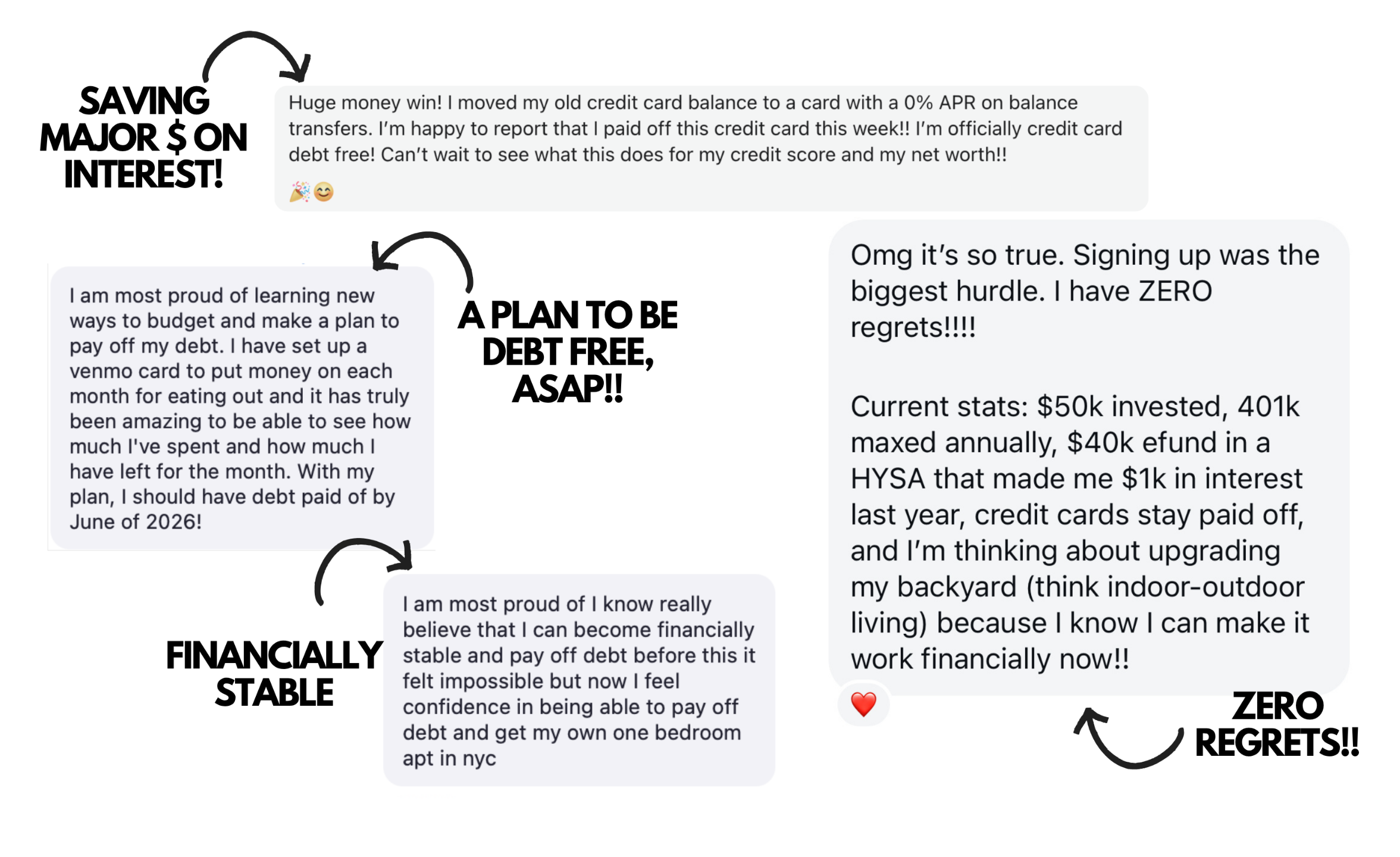

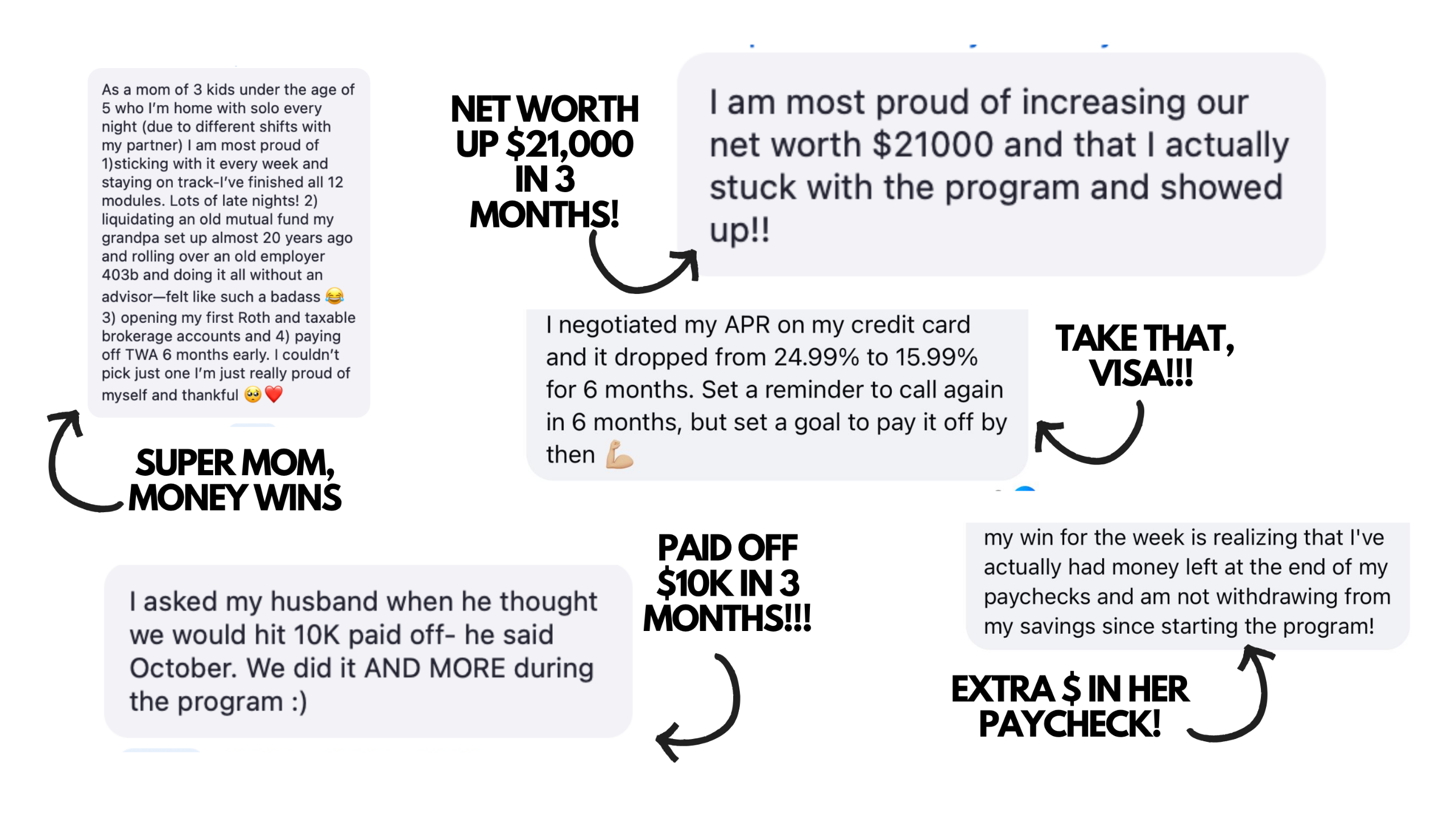

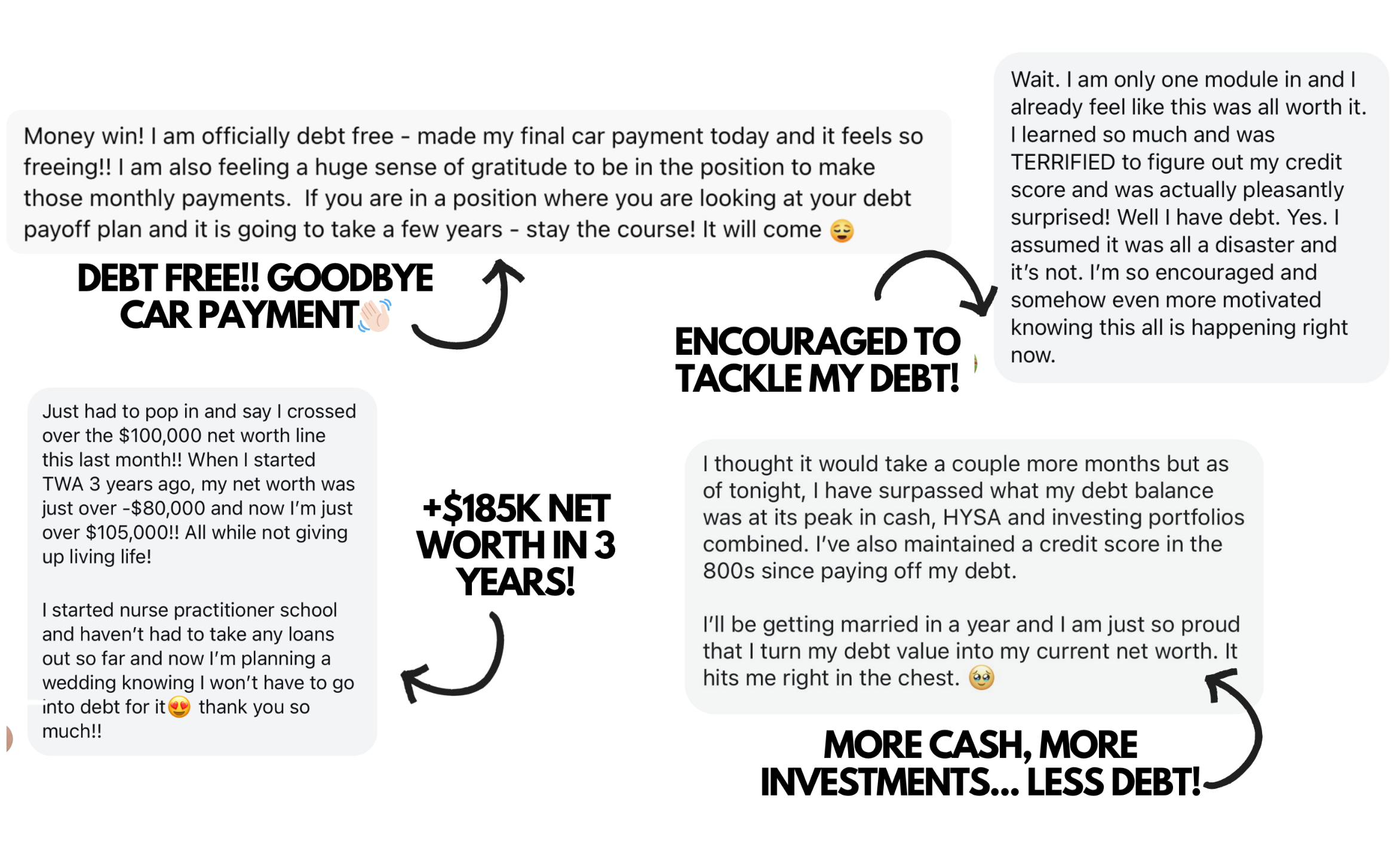

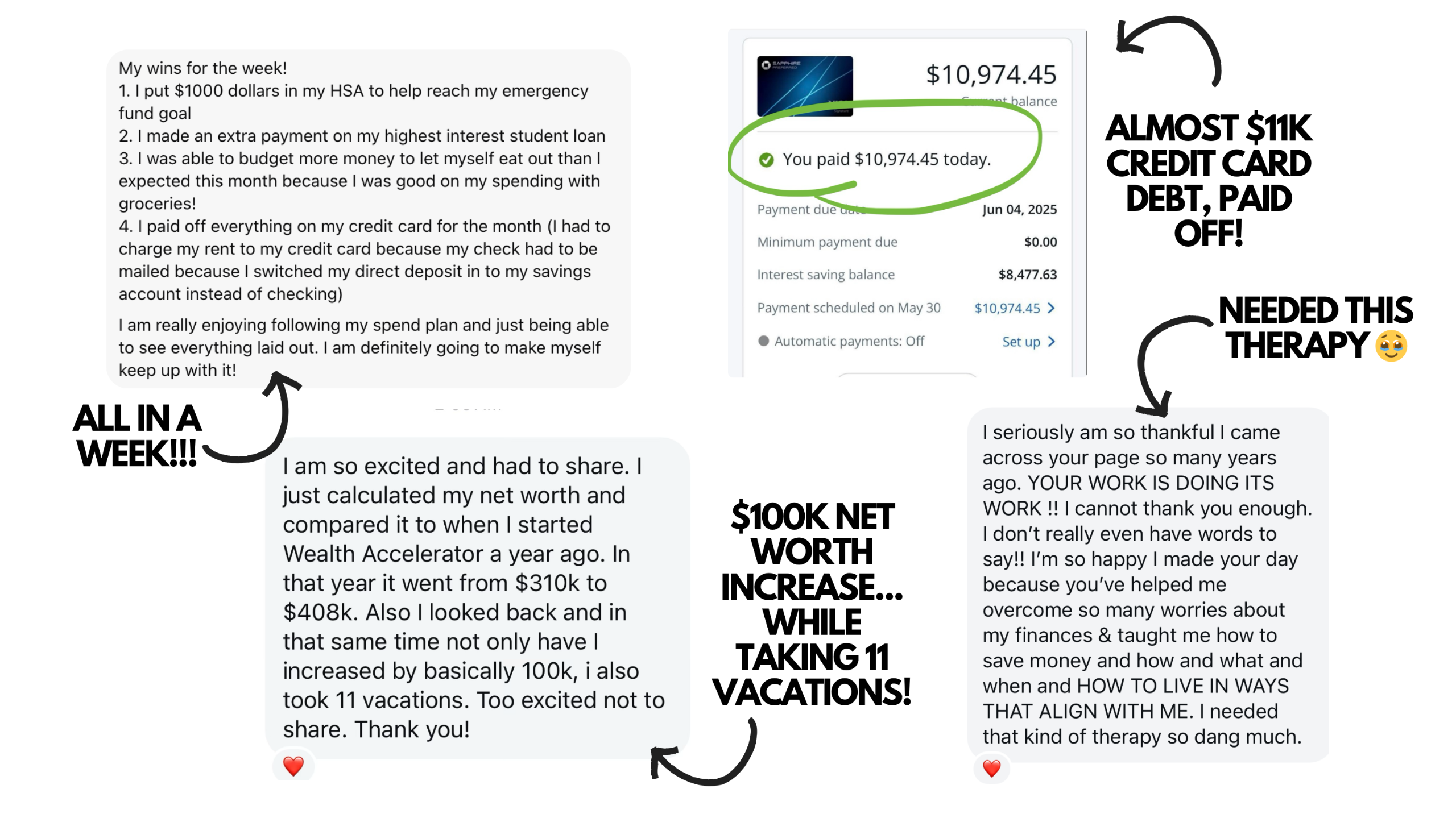

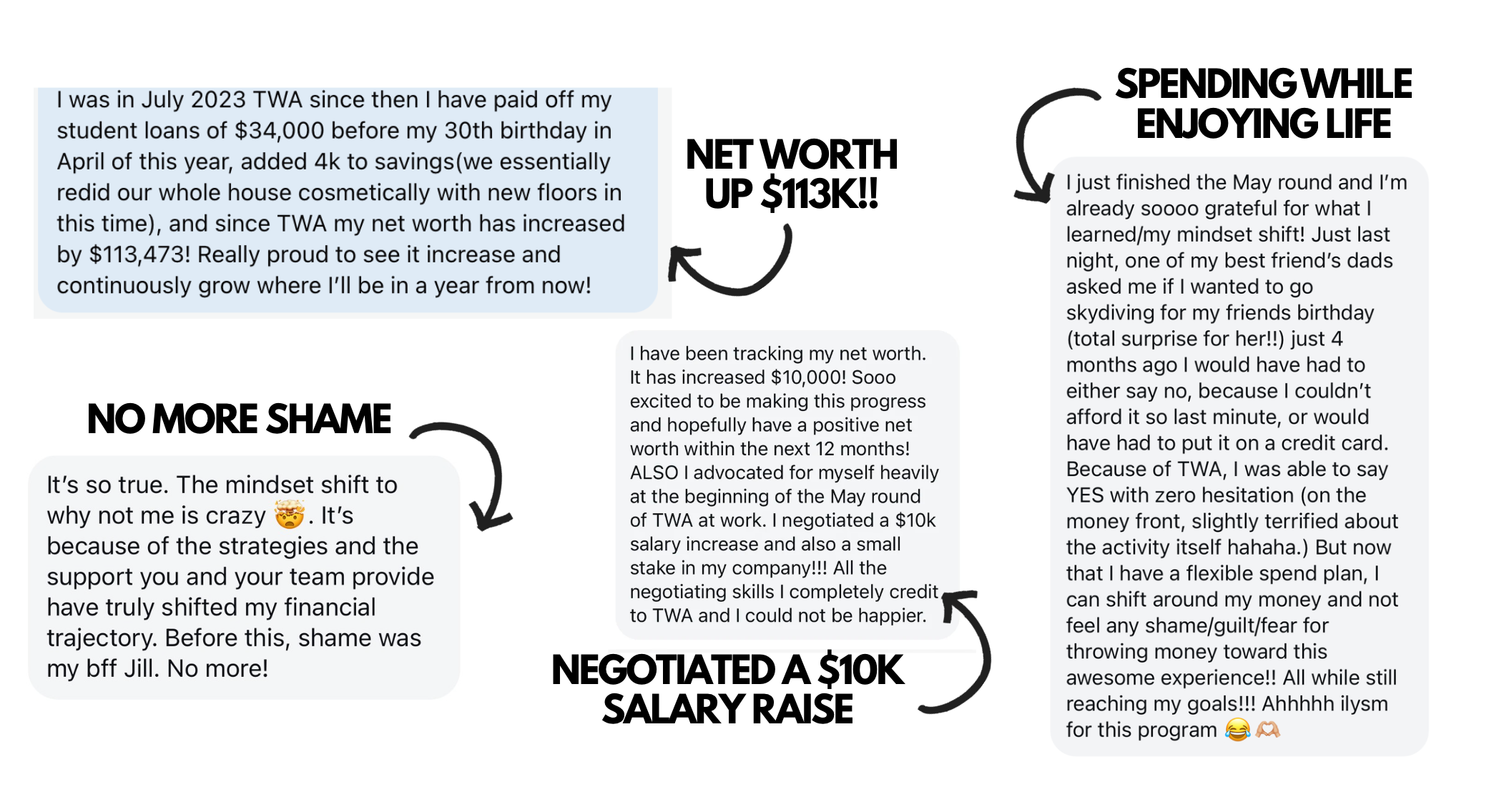

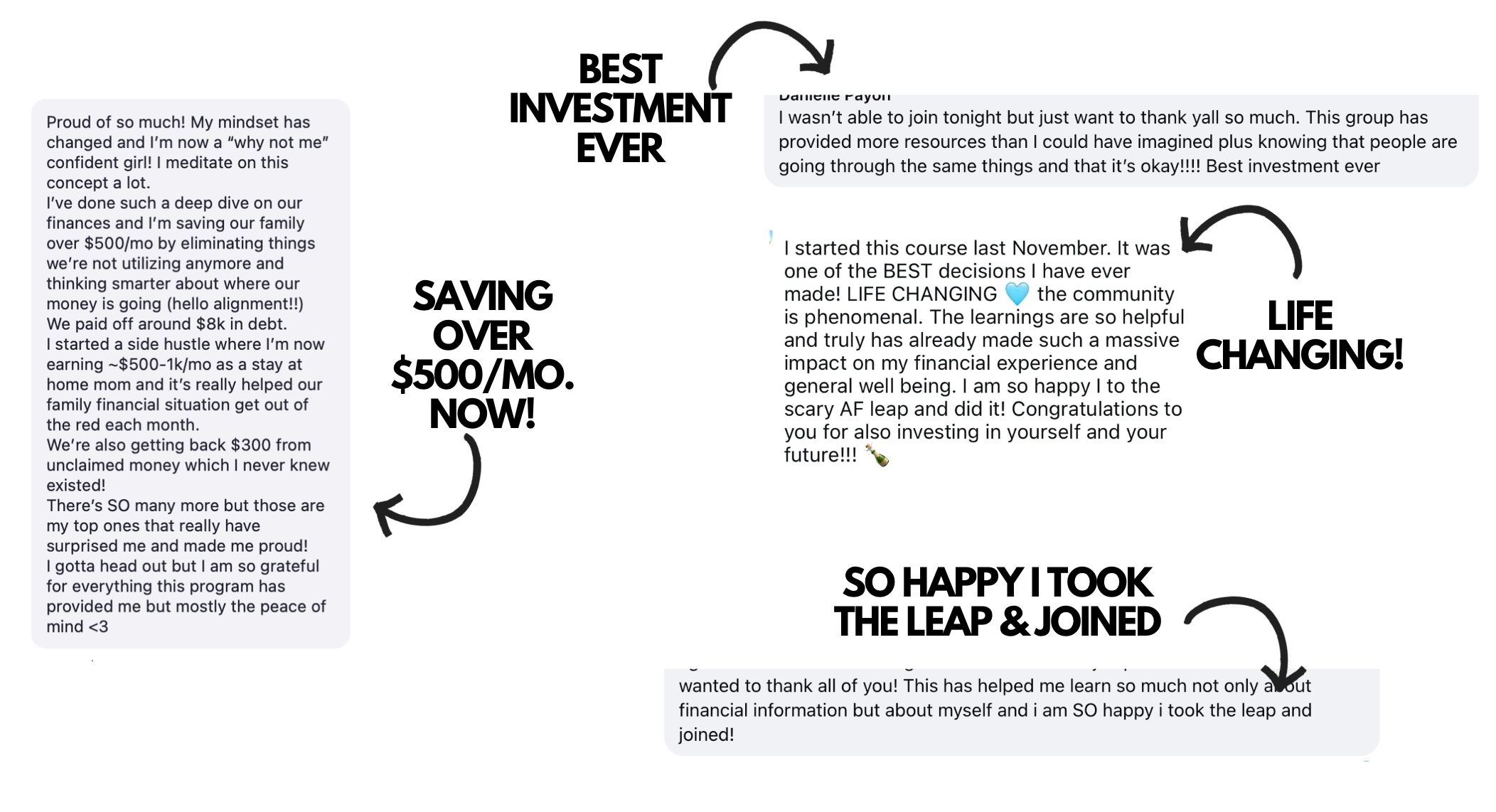

Testimonials

OUR CLIENTS HAVE TOO MANY AMAZING WINS TO SHARE (on one page!)

Here's a sneak peak:

“The Wealth Accelerator was by far one of the best experiences of my life. I’ve paid off over $8,000 of credit card debt in the 3 months and have grown so much as a person.”

READ MORE CLIENT REVIEWSSide effects may include:

CHECKOUT SOME OF THE AMAZING WINS & FEEDBACK OUR ALUMNI HAVE SHARED

You may be wondering...

DOES EVERYONE GET ACCEPTED?

IS IT NORMAL TO BE SCARED TO APPLY?

IS CHLOE'S BOOK A SUBSTITUTE FOR WEALTH ACCELERATOR?

WHAT KIND OF SUPPORT WILL I GET?

A note from the founder, Chloe Elise...

It took me 7+ years to figure out all of these strategies and go from broke college girl to millionaire.

This program is the step-by-step roadmap of my journey...packed into 12 weeks.

Seven years ago, I laid in my college bunk bed and cried after reading a finance book that left me even more confused, overwhelmed, and guilty for every dollar I was spending.

The Wealth Accelerator is the resource I prayed and searched for when I first started my financial journey. Every resource that existed was filled with shame, and made me feel like sh*it for not wanting to put my whole life on hold and live off rice and beans just because I had student loan debt.

I founded Deeper Than Money in 2018 after paying off $36k of debt in 18 months, on a mission to teach people how to take control of their finances and change the trajectory of their lives.

The Wealth Accelerator is my baby. In the past 5 years, I've had the honor of helping 1,000+ clients' transform their finances and start to watch their net worth skyrocket. It's the most rewarding thing in the world, and I am so excited to help you do the same.

I know it's probably out of your comfort zone. I know your brain is probably thinking of every reason why you're the exception, and why it could never work for you. Every person who has gone through the program has felt the same way. Investing in yourself can be scary.

During the program we show you implement strategy to help you *keep* more of the dollars you are bringing in, in your pocket. Making your cash flow as efficient as possible. That’s how investing in yourself pays for itself not just during the 12 weeks, but especially over the course of your life.

Our goal is to provide every financial resource you could ever need inside Wealth Accelerator, and for it to be the resource you have in your back pocket for the rest of your life. Whether you're just starting out with money, or looking to level up your investing game-- I promise, Wealth Accelerator will click for you.

I WANT TO LEARN MORE!